Victims of a fraudster who conned friends and family – including his daughter – into putting £3million in a bogus investment scheme have told how he ‘destroyed’ their lives.

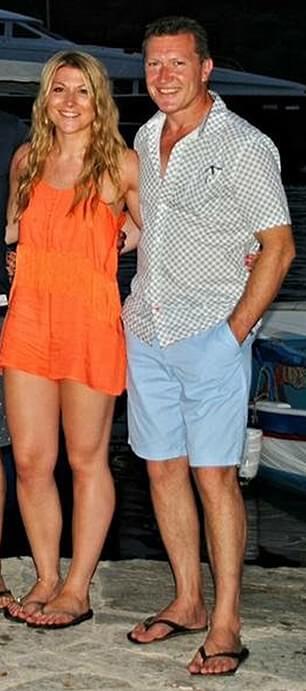

Mark Starling, 57, spent a decade convincing investors, including millionaires at his local rowing club, to let him manage their savings.

Of the £3million handed over to him, he only actually invested £8,000 – of which he lost £2,450.

The father of three blew more than £1million on his children’s private education, property, cars and exotic holidays.

He was jailed last month for five years after admitting fraud and operating unauthorised investment schemes between 2008 and 2017.

The Daily Mail can now reveal the appalling web of lies Starling span by targeting those who loved him most.

His eldest daughter Rosalie, 27, invested at least £8,500 while his 29-year-old nephew Christopher Bullett put in a similar amount.

A total of 17 investors are set to lose a total of £1.8million. Some had cash returned to them over the course of Starling’s fraud.

Victims told how they were ‘suckered in’ by Starling’s charm as he played on his standing as a pillar of the local community.

He kept up the facade with faked monthly investment updates showing impressive returns, while pretending to go to business meetings in the City and on the Isle of Man.

At one point he even took investors on a trip to Le Mans race track in France – without them knowing they were funding it themselves.

Those he fooled included friends he had known for up to 35 years, and others who would dine with the family-of-five at their luxury rented home in Farnham, Surrey. An oil executive at Starling’s rowing club ploughed in nearly £500,000.

For some investors their losses will be ‘life-changing’ – with a pensioner having to return to work after trusting Starling with their retirement cash.

An office worker said she had invested tens of thousands of pounds in the hope it would provide for her children’s future.

A defrauded investor said: ‘Knowing that he was actually destroying peoples’ lives while putting his kids through private schools – it is just incredible. The most unbelievable behaviour I have ever come across.’

Starling’s deception began in 2008 when he told friends he had become a ‘proprietary futures trader’ and had developed a strategy that promised a low-risk investment with returns of up to 18 per cent a year

Mark Starling, 57, spent a decade convincing investors, including millionaires at his local rowing club, to let him manage their savings

One investor said she even joked with Starling, asking him: ‘You’re not going to run off to Bermuda with my money, are you?’ She said: ‘He was absolutely charming – a good laugh. He seemed so kind and genuine. A lovely family with the three lovely girls – why wouldn’t I trust him?’ Another investor who lost a small fortune said: ‘I just can’t comprehend how someone can treat friends and family this way – all the while living off their savings.

‘The impact this has had on people’s lives and their families is immense and makes this completely unforgivable. I have absolute hatred and anger towards Mark. he does not deserve any sort of comfortable life after this The fact that he has received such a short sentence and will return to the community is no justice at all.’

Starling spent £220,000 on property, £165,000 on school fees, £46,000 on shopping and £30,000 on cars. He spent £42,000 on family holidays, including annual ski holidays to friends’ chalet and two-week summer breaks in a Southern European villa.

Michael Hick told Southwark Crown Court: ‘Unfortunately the scheme was a scam from the start. The money was used to allow Mr Starling to live a comfortable life without the hassle of having to go to work or pay tax.’

Judge Philip Bartle QC, sentencing Starling, said: ‘He did not do a stroke of work over these years, he didn’t do a stroke of lawful, gainful employment … it was, in short, a pack of lies over a very long period of time.